"Aggregated Group Indicator" error (1095-C Error Only)

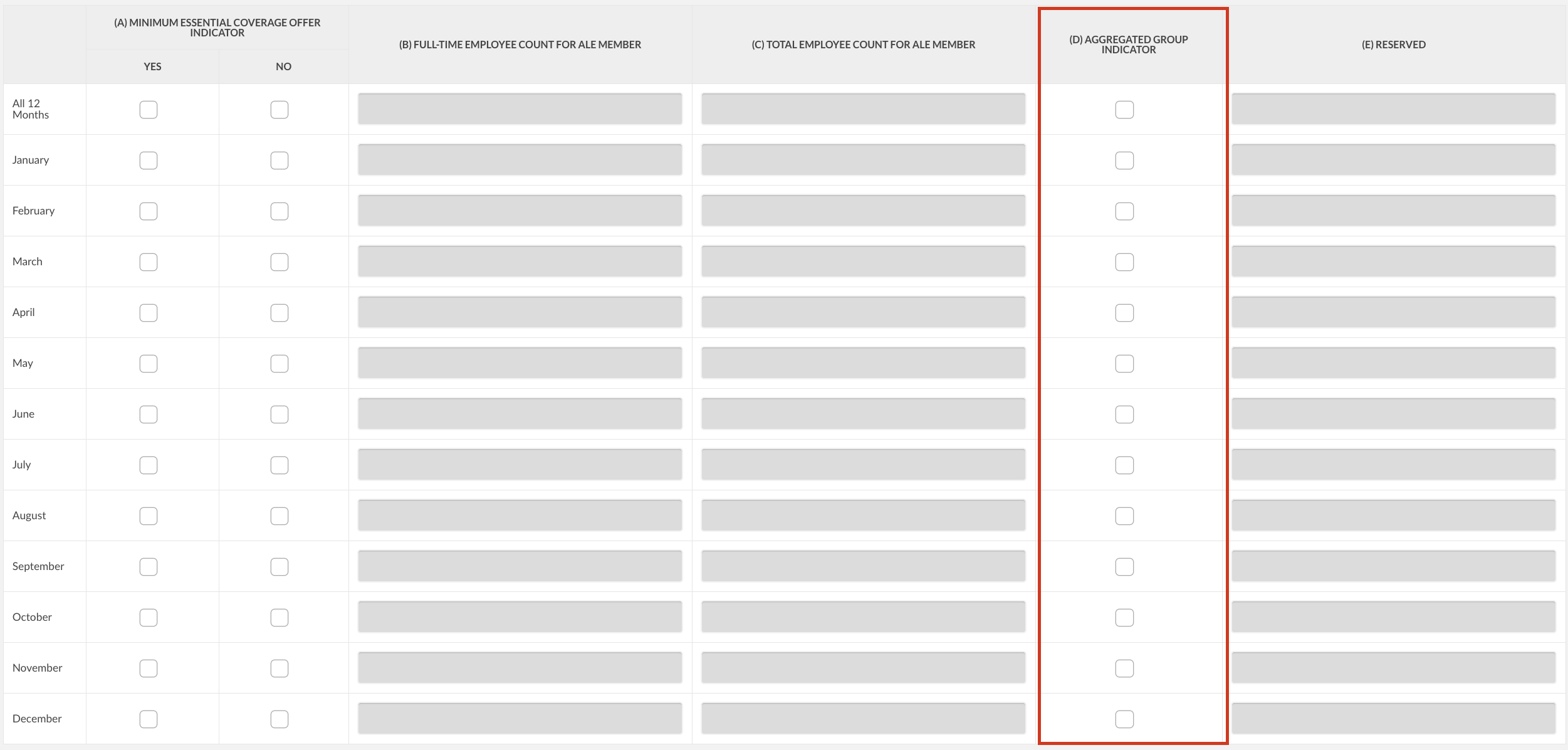

This error is caused by the "Aggregated Group Indicator" section highlighted below not being checked properly:

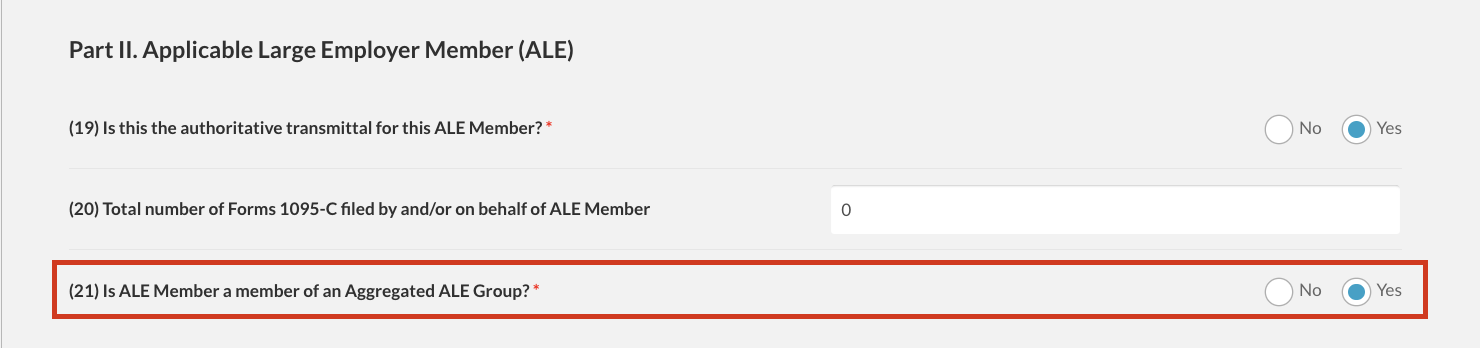

This section is required to be checked because "Yes" is selected for question 21, "Is ALE Member a member of an Aggregated ALE Group?":

To correct these errors, you will need to do the following:

- Log into the employer account in BerniePortal.

- Click on "1094/1095" at the top of the page.

- Click "Subgroups".

- Click on the name of the subgroup you are working to correct.

- Scroll down to "Part III - ALE Member Information - Monthly"

- In Section D, "Aggregated Group Indicator":

- Check the box for "All 12 Months", OR

- Check the box for each month if the ALE member was not a member of an aggregated ALE group for all 12 months.

- Scroll down to the bottom of the page and select "Corrected Form".

- Push "Save Changes".

- Repeat this process for all 1094C subgroups (if applicable) until you are finished.

If you incorrectly marked question 21, "Is ALE Member a member of an Aggregated ALE Group?" as "Yes" and need to change it to "No":

- Log into the employer account in BerniePortal.

- Click on "1094C/1095C" at the top of the page.

- Click "Subgroups".

- Click on the name of the subgroup you are working to correct.

- Scroll down and select "No" for question 21 "Is ALE Member a member of an Aggregated ALE Group?":

- Scroll down to the bottom of the page and select "Corrected Form".

- Push "Save Changes".

- Repeat this process for all 1094C subgroups (if applicable) until you are finished.

Didn't find what you were looking for? Send us a ticket.

Related Articles

What is an Aggregated ALE Group?

An Aggregated ALE Group consists of related companies that must be combined when determining ALE status, even if each individual company has fewer than 50 employees. Companies with a common owner or that are otherwise related under certain rules of ..."Other Members of Aggregated ALE Group" error (1095-C Error Only)

This error is triggered for one of three reasons: One of the business names and/or EINs within the "Other Members of Aggregated ALE Groups" does not match what the IRS has for the business name and/or EIN. NOTE: If you believe the name and/or EIN are ..."Minimum Essential Coverage Offer Indicator" error (1095-C Error Only)

This error is caused by the "Minimum Essential Coverage Offer Indicator" section highlighted below not being checked properly: To correct these errors, you will need to do the following: Log into the employer account in BerniePortal. Click on ...What is the difference between a 1095-B and 1095-C form?

The critical difference comes down to employer size: Employer Size Funding Type Form Required Under 50 full-time employees Self-insured 1095-B Under 50 full-time employees Fully insured None (carrier files 1095-B) 50+ full-time employees Self-insured ...Configuring your 1094-C/1095-C forms

Once you have finished configuring your subgroups, you should navigate HERE to begin configuring your subgroups. Click on your 1094 subgroups to configure them. In the image below, we will click “All Employees” to begin our configuration: IRS ...